Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 16:34:00

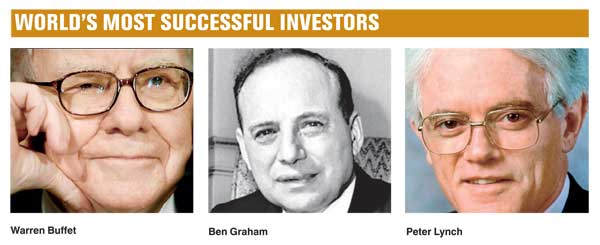

The thought of investing in the stock market may seem a little frightening at first, especially for those who have never done so. Wading into any uncharted territory is scary, but armed with knowledge and guidance, the stock market is not so difficult to navigate and shares should form an integral part of any investment portfolio.

The thought of investing in the stock market may seem a little frightening at first, especially for those who have never done so. Wading into any uncharted territory is scary, but armed with knowledge and guidance, the stock market is not so difficult to navigate and shares should form an integral part of any investment portfolio.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul