Reply To:

Name - Reply Comment

Last Updated : 2024-04-20 20:10:00

We preach that Sri Lanka is a Democratic Socialist Republic and practice social-market economy. One of the measures to see the role of government in the social sector is to look at the total tax collection from the rich and the subsidies afforded to the less privileged people in society.

We preach that Sri Lanka is a Democratic Socialist Republic and practice social-market economy. One of the measures to see the role of government in the social sector is to look at the total tax collection from the rich and the subsidies afforded to the less privileged people in society.

The rich countries’ tax collection is around 45 percent to 50 percent of gross domestic product (GDP) and they in turn invest 12 percent to 18 percent on health and education, whereas in Sri Lanka, our tax revenue is around 13 percent and how much do we spend on education and health?

Last year, the government spent only 3.6 percent on health and education, where more than 25 percent of our people live below the poverty line. In fact, there has been a reduction in the capital expenditure on health in 2016 compared to the previous year. Our health and education services are fast deteriorating to a level where we could end up in having unhealthy and less educated children similar to the population living in least developed countries.

Growing civil unrest due to poor health and education facilities

The growing tax collection has enabled the developed countries (the US, Britain, France and Sweden) to take on social welfare functions. A major portion goes to health and education. Spending on education and health accounts for 12 percent to 18 percent of national income in all the developed countries today.

Primary and secondary education are almost entirely free for everyone in all the rich countries but higher education can be quite expensive, especially in the United States. In all the developed countries, public spending covers much of the cost of education and health services. The goal is to give equal access to these basic goods: every child should have access to education, regardless of his or her parents’ income and everyone should have access to healthcare.

In Sri Lanka, the situation is totally different. Public spending on education and health services is totally inadequate. One of the fundamental problems in Sri Lanka is that we have very low national savings resulting a gap between investments and savings. Our economy is stagnating and foreign and local investments are at a very low level. (Average foreign direct investments (FDIs) during the last five years is around US $ 800 per annum whereas our debt servicing alone is around US $ 4,600 per annum).

As a result, the government is compelled to curtail investment in people. The successive governments have failed in bringing social justice and much-needed economic welfare to the people. Consequently, the income inequality and social unrest are fast spreading across the regions, sub-districts and cities. Most of the top business leaders and professionals are of the view that the quality of life of not only poor, even the middle class is drastically reducing.

As per the Central Bank report 2016, the economy has been stagnating around US $ 82 billion in terms of GDP and the external debt outstanding as at end-December 2016 has increased to US $ 46.6 billion. In fact, the per capita GDP income has come down from US $ 3,843 to US $ 3,839 in 2016.

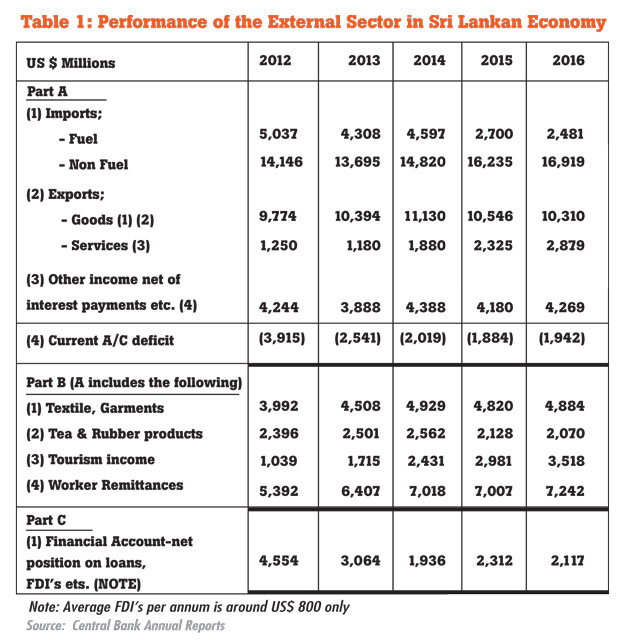

The external account performance is fast deteriorating. Despite continuous borrowings, our foreign reserves are declining and debt servicing is ever increasing. As can be seen from Table 1, there is a persistent balance of payment (BOP) deficit, which had been financed through high-cost borrowings.

Export earnings are declining for the first time in the last two decades and except tourism income all other exports such as tea, rubber products, textile and garments, gems and jewellery, etc. are stagnating if not declining. There has been a substantial savings on fuel bill during the last two years, yet the trade deficit widens as we continue to spend foreign exchange to import dairy products, sugar and even rice, wheat, maize, etc.

Persistent BOP deficits financed by heavy borrowings

These statistics are not sufficient to explain the real downturn. Basically, the countries’ external account has been in deficit of US $ 2 billion per annum before debt amortization/servicing.

The government is now compelled to borrow external debt on non-concessionary, commercial terms in order to finance the deficit. The current government continues to borrow foreign funds at relatively higher interest rates in order to retire previously obtained low-cost borrowings. According to the auditor general’s findings, the government debt as a percent of GDP has increased to 83 percent by end-2016, which includes US $ 27.8 billion foreign loans obtained by the government.

However, if we take into account the overall external debts obtained by the country, it works up to US $ 46. 6 billion. If we add the overall external debt of Rs.6,785 billion (equivalent of US $ 46.6 billion) to the o/s domestic debt, then the total debt works out to Rs.12,600 billion. This, as a percent of GDP of Rs.11,839 billion was 106 percent of GDP, which is excessive.

Is IMF loan similar to bailout package given to Greece?

Unfortunately, the country’s gross official reserves are fluctuating around US $ 6 billion, which is sufficient only for four months of imports. However, we are now under the International Monetary Fund (IMF) programme Extended Fund Facility (EFF) where a total sum of US $ 1.5 billion is due to be disbursed during the’ three-year period. (Already two tranches have been received)

It is in this context only we need to assess the current scenario to ascertain whether Sri Lanka could come out from the present economic crisis without burdening the poor anymore. It may be relevant to compare and contrast the economic situation faced by Greece today, where the IMF came with a recipe similar to one that prescribed to Sri Lanka when Greece had to face a serious financial crisis somewhere in 2008.

Greece had experienced strong economic growth till 2006 where GDP was around 4-6 percent and the budget deficit was around 5-7 percent with relatively higher per capita income. During the financial crisis in 2008, the budget deficit of Greece has exceeded 15 percent and the economy was stagnating. They were forced to accept a bailout package from the IMF and EU banks but those came with conditions. As in the case of Sri Lankan present situation, lenders imposed harsh austerity terms, requiring deep budget cuts and steep tax increases.

Greece announced in October 2009 that it had been understating its deficit figures for years, raising alarms about the soundness of Greek finances. (The Sri Lankan auditor general has recently given a ‘disclaimer’ to the Finance Ministry 2016 accounts claiming the ‘public debt’ figures in the accounts have been understated).

Suddenly, Greece was shut out from borrowing in the financial markets. To avert calamity, the so-called troika — the IMF, European Central Bank and European Commission — issued the first of two international bailouts for Greece, which would be 240 billion euros. The money was supposed to buy Greece time to stabilize its finances. Measures ranging from the overhaul of the pension system to increase in indirect taxes (VAT) are cited by Greeks now reneging on loan repayments, property taxes and energy bills.

The IMF has insisted that Greece cannot meet its budget goals without easing its debts, while Germany remains sceptical of cutting Athens spending. Germany and its bankers want Greece to reform its financial structure. International lenders have struggled for seven years to agree on its resolution. New York Times on June 17 explaining the debt crisis of Greece noted that the IMF and Germany were lining up on opposite sides.

During the period from 2010 up to now, the Greek economy has shrunk 25 percent because of spending cuts and tax increases demanded by creditors. As a matter of fact, Greece became the first developed country to fail to make the IMF loan repayment.

Greek economy from bad to worse?

Last year was meant to be a year of recovery – instead, uncertainty has prompted the Central Bank to revise its growth projection downwards following the economy’s contraction in the fourth quarter last year. The economy has shrunk by a quarter (25 percent) in six years and unemployment is about 24 percent. The bailout money mainly goes toward paying off Greece’s international loans, rather than making its way into the economy.

It is evident that despite the IMF bailouts, Greece’s economic problems have not gone away. Consumption is also down. “The 37 percent of Greeks at risk of poverty and social exclusion really cannot make ends meet,” said Aliki Mouriki, a leading Greek sociologist.

“They no longer have the means to meet the basic needs, with consumption of milk and bread right down and payment of electricity bills at an all-time low.”

According to foreign media, the farmers who travelled to Athens have clashed with riot police outside the agriculture ministry, in the latest unrest on the streets of the Greek capital, prompted by the government’s austerity policies.

“No economy can withstand endless recession and stagnation, it’s anyone’s bet what will happen if the economy doesn’t [exhibit] a strong recovery in 2017,” says George Pagoulatos, Professor of European Politics and Economy at Athens University.

Ancient Greece and Anuradhapura kingdom similarities

During the ancient period, there were similarities between ancient Greece and the Anuradhapura kingdom. The emergence of the entire western philosophical tradition can be traced back to the golden era of ancient Greek philosophy. As in the case for Sri Lanka, agriculture was the foundation of the ancient Greek economy.

Aristotle (384 BC-322 BC) is truly a key figure in the ancient Greek philosophy and he is considered as Athenian philosopher Plato’s (pupil of Socrates) most famous student. His main works were on ‘prior analytics’ in which he described the ‘rule of logic’. During this time period only, the Anuradhapura kingdom was first established in Sri Lanka formed by King Pandukabhaya in 377 BC.

It was during King Devanampiyatissa’s time (307 BC) that Arahat Mahinda, son of Emperor Asoka of India, arrived and officially established Buddhism in the island. He wanted to preach dhamma to the king and his minors but was not sure how intelligent the king and the followers were. Therefore, he wanted to test ‘logic’ where the king successfully answered to the questions posed by Arahat Mahinda. (Famous questions and answers on mango tree in Mihintala).

The Sri Lankan agriculture sector and paddy cultivation flourished under Devanampiyatissa, who is considered as a true national leader. (During this period Sri Lanka earned the nick name ‘Granary of the East’). Alexander the Great, king of Macedonia, considered as one of the greatest military geniuses of all times, was his contemporary and was educated by the great philosopher Aristotle (3564 BC-322 BC). It is a pity that both countries are now faced with serious economic crises mainly due to the absence true national leadership in order to improve the social and economic welfare of the people on a sustainable basis.

Will Sri Lankan BOP situation deteriorate further?

The Central Bank in its latest report stated that Sri Lanka’s attractiveness for FDIs has remained low and a reversal of this is urgently required. It goes without saying that the political stability is the most important and necessary prerequisite in creating an enabling environment for FDIs.

The government must also facilitate and encourage businesses to improve competitiveness and enhance performance in order to stimulate economic growth. Only then the businesses thrive so that the inland’s revenue department could collect higher taxes on progressive basis without increasing indirect taxes arbitrarily.

Fiscal consolidation must be achieved through increased revenue and cut on unnecessary government expenditure and waste. Instead, if the government tries to increase VAT, NBT, etc. then both the rich and poor have to pay taxes equally, negating the very basis of progressive tax system. The result would be that social unrest will accelerate with widespread of income inequality.

One of the major drawbacks during the last two-year period is in the delays in execution of policies and projects. Getting policy implementation right is critically important for ‘governance’ purposes. The government must continue on the on-going infrastructure development projects using FDIs so that the government could provide sufficient funds for improvements in health and education. My own view is this must receive highest priority of the policy makers.

There are serious mismatches between the needs of the economy and output of the higher education system. There are major epidemic issues in the current healthcare services as there is a major inequality in the healthcare availability across the country.

Conclusion

It goes without saying that improving economic growth in terms of GDP has become a necessary prerequisite to enhance the quality of life of our people. The business community has been emphasizing the need to have political stability and consistency in government policymaking to spur much-needed economic growth.

The country must adopt an ‘investment-led’ growth strategy as the ‘export development’ has just become a buzz word only. However, if the above-mentioned deep-rooted structural issues in the economy are not addressed urgently, there is a greater probability that the Sri Lankan ‘BOP’ situation will further deteriorate.

In the medium term, both the income inequality as well as the unemployment rate will further widen. This will lead to further unrest among the people. The popular belief is that the successive governments have failed in bringing social justice and much-needed economic welfare to the people. It seems that the real crisis confronted with the country’s governance is a lack of a people-oriented visionary leadership.

(Jayampathy Molligoda can be reached via jayampathy@bpl.lk)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t