Reply To:

Name - Reply Comment

Last Updated : 2024-04-25 17:00:00

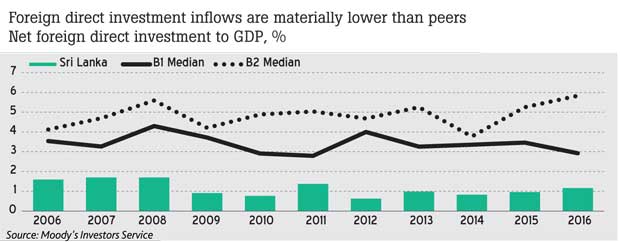

International credit rating agency Moody’s Investor Services yesterday gave a grim forecast for Sri Lanka’s foreign direct investment (FDI) prospects, saying that FDI flow for the dollar-hungry nation in the next two years is likely to remain at current levels despite reform efforts by the government.

In its latest report titled, ‘Government of Sri Lanka – External Pressures Constrain Credit Profile’, Moody’s said Sri Lanka’s significant borrowing requirements and heavy reliance on external and foreign currency funding expose the sovereign to material liquidity and external financing risk, which weighs on the sovereign’s

credit profile.

Although the government’s reform efforts could lift the inflows in the medium-term, “we expect FDI inflows to remain near current levels over the next two years, which will not be large enough to fully finance the current account deficit”, Moody’s noted.

Moody’s has a B1 speculative rating on Sri Lanka with a negative outlook.

Although Foreign Direct Investments picked up markedly since Sri Lanka crushed the separatist terrorist elements in 2009, such long -term inflows have been languishing for years— a situation largely in contrast with post-conflict nations such as Vietnam and Myanmar.

The government has streamlined the country’s main tax law and is in the process of putting a single window for trade and information in place while reforming the country’s trade policy to better facilitate trade and improve export competitiveness.

But with all that, in 2016, the post-war Sri Lanka managed to lure less than US $ 500 million in FDIs, which is just 1.2 percent of the Gross Domestic Product, significantly lower than its Asian peers.

That means Sri Lanka will have to continue to borrow from abroad at commercial rates, sinking deeper into debt unless the government commits itself towards closing its fiscal hole and come up with a credible external liability management framework.

“Unlike some other economies in the region, Sri Lanka has not attracted large FDI inflows. Instead, its current account deficit is partly financed through debt inflows from long-term government loans, including international sovereign bonds and syndicated loans, and foreign borrowing of the private sector.

We do not expect the broad structure of Sri Lanka’s external flows to change, leading to a further accumulation of debt liabilities”, Moody’s said.

Current account balance of the balance of payment is the net of trade flows, services flows and primary and secondary flows such as worker remittances. Sri Lanka’s current account deficit was 2.4 percent of GDP and Moody’s forecasts it temporarily widening to 3.0 percent in 2017 due to higher oil and rice imports before settling around 2.3 percent during 2018 and 2019.

But Sri Lanka failing to meet its current account deficit through FDIs is worrisome as the country will have to resort to borrow to close that gap, adding to the already high debt pile.

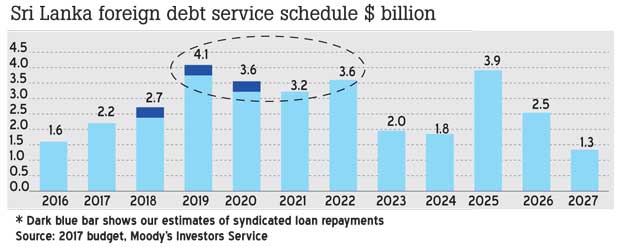

The rating agency joined the World Bank and many other economists to caution Sri Lanka over its plans to rollover significantly high debt maturities coming up from 2019 onwards as the global interest rates are on the rise and the liquidity could evaporate from capital markets.

Moody’s data illustrations show that Sri Lanka’s external debt maturities/repayments are set to rise to US $ 4.1 billion in 2019 from US $ 2.2 billion this years and US $ 2.7 billion next year.

Over the four years from 2019 to 2022, average debt repayments will be US $ 3.6 billion annually.

“Although we expect most of these maturities to be refinanced, the bunching of such large repayments raises rollover and external vulnerability risks”, Moody’s said.

As of 2016, Sri Lanka’s total external debt (local and foreign currency external debt of combined public and private sectors) was about US $ 47 billion (about 57 percent of GDP), of which approximately 68 percent was public sector debt.

The government’s foreign currency-denominated debt was about 43 percent of total general government debt in 2016 and about 34 percent of GDP.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul