Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 17:01:00

Sri Lanka will meet all its external debt obligations due in 2020 and would also regain access to international markets in the year that follows, albeit there could be some weaknesses persisting in the country’s external liquidity position even beyond the coming Parliamentary elections, says Fitch Ratings.

In what could be termed as a symbol of confidence on the Sri Lankan economy, which is coming out from coronavirus related restrictions, the global rating agency sounded cautiously optimistic on the sovereign’s external credit profile as the authorities are working with bi-lateral and multi-lateral credit agencies for additional financing.

“We believe the government will be able to finance its maturing external debt in 2020 through loan disbursements from bilateral and multilateral agencies, apart from the sovereign bond obligation that is due, which we assume will be met out of reserves,” Fitch Ratings said in a note on the country’s external

liquidity position.

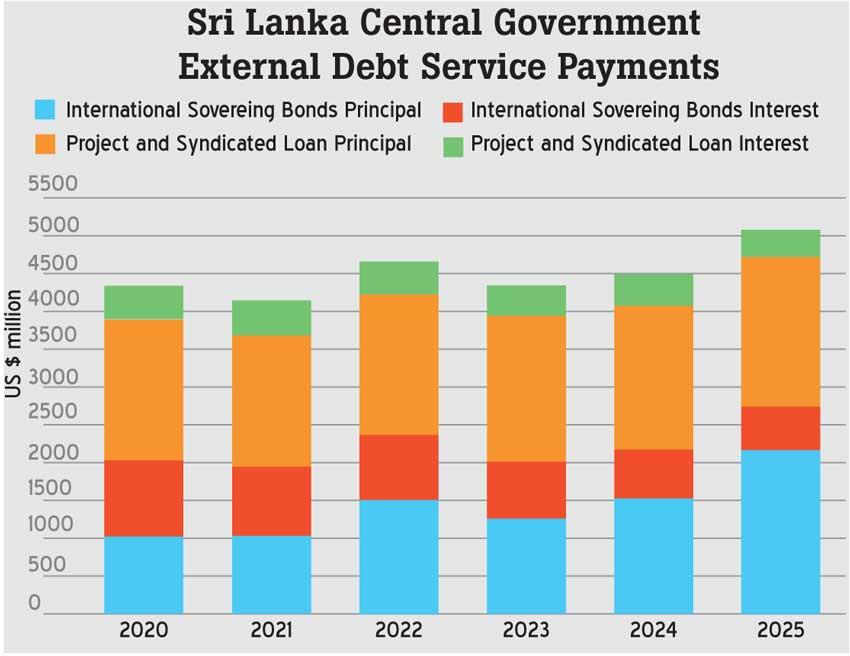

Sri Lanka’s international reserves fell by US$ 716 million in May to US$ 6.5 billion, and the country has external debt servicing payments to the tune of US$ 3.8 billion from June to December 2020, including a billion dollar sovereign bond retirement.

Fitch Ratings in April downgraded Sri Lanka’s sovereign rating to ‘B-’ from ‘B’ with a Negative rating outlook citing serious concerns about external financing challenges. Sri Lanka’s liquid external assets as a percentage of liquid external liabilities are at around 60 percent, lowest in its

rating category.

But with signs of retuning to growth in many spots in the world, combined with indications of stabilisation elsewhere, as indicated by the PMI data, economists and analysts are now reassessing their most pessimistic projections, which were rushed during the peak of the pandemic.

Sri Lanka joined the United States, France, the United Kingdom, Australia, Germany and several other economies, which registered a stronger rebound in their PMIs as the country’s Purchasing Managers’ Index bounced back in May, with the index values for manufacturing and services jumping to 49.3 and 43.1 index points respectively, from 24.2 and 29.8 index points recorded in April.

Meanwhile, the provisional export figures also showed a strong rebound for May, with earnings rebounding to US$ 602 million from US$ 282 million

in April.

As coronavirus-induced market unease impaired Sri Lanka’s access to international capital markets, the authorities turned to non-market sources, including both lending and swap facilities and also made a request for US$ 800 million from the International Monetary Fund (IMF) for the next two years under its Rapid Financing Facility.

Besides the above, the government also announced last week that it was seeking proposals from domestic and foreign banks to raise US$ 500 million.

While Fitch had not incorporated the possible IMF support and access to international capital markets in its 2020 projections, the rating agency sounded sanguine over the country’s ability to ease external funding strains, at least in the near term, “if the authorities secure substantial support beyond the rollover of existing debt incorporated in our assumptions.”

Meanwhile, echoing Central Bank’s expectations, Fitch Ratings also expected Sri Lanka to regain international market access from 2021 onwards, by which time the external financing conditions are expected to improve.

Sri Lanka on average has US$ 4.3 billion of debt service obligations per annum from 2021 to 2025, which is considered “substantial” by Fitch and, underscores the persistent challenge the country faces in re-financing its external liabilities.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul