Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 15:12:00

As of December 12, 2014, the All Share Price Index (ASPI) is still up 21 percent year-to-date despite losing around 4 percent from the all-time second highest peak of 7,548 index points reached on November18, 2014.Net foreign purchases also have topped Rs.22 billion so far this year, primarily with the global investors taking a macro call on the country and with global frontier market funds raising more money necessitating an increase in allocations.

As of December 12, 2014, the All Share Price Index (ASPI) is still up 21 percent year-to-date despite losing around 4 percent from the all-time second highest peak of 7,548 index points reached on November18, 2014.Net foreign purchases also have topped Rs.22 billion so far this year, primarily with the global investors taking a macro call on the country and with global frontier market funds raising more money necessitating an increase in allocations.

However, with the year coming to a close with the holiday season around the corner, investor activity both foreign and local should be expected to dwindle and turnover levels to dive in the coming weeks.Since last month, political uncertainty did disrupt the upward momentum of the ASPI and made the market to move sideways though no serious damage had been made.Also, it could be viewed as a positive, with the much-needed breathing space allowing investors to consolidate and rethink their portfolio mix and to align themselves with shares which tend to be fundamentally attractive having a stable earnings outlook.

SCARCE DOWNSIDE IMPACT ON CSE

The weak market liquidity levels and the sideways movement at the Colombo bourse, which could be the most likely scenario during the next few days, should not be a deterrent since the political uncertainty which triggered the current volatility is now waning.Despite the political situation and the election campaigning yet to hit its climax, market participants have come to terms with such and now understand the polity developments will have scarce downside impact on the Colombo Stock Exchange (CSE).Therefore, provided rationality prevails, the CSE should only be positively affected once the political noise is settled after January 8, 2015. In the new year, provided there would not be any major policy changes, the Colombo bourse would be only marginally influenced by internal dynamics but more so affected by the external developments.

The year 2014 was by and large spent on the expectation of US tapering and the resultant global interest rate spikes. And when the much-anticipated rate hike was not coming through, such was expected to take place in 2015 and with much certainty since the economists felt it was far overdue. At least that was the thinking a few months back.

However, now opposing opinions are beginning to be voiced and by prominent economists such as Nobel Laureate Paul Krugman, who believes t hat t he US cannot afford to curtail their expansionary policies in 2015, given the global economic slowdown.His argument is t hat, if developed economies halt their expansionary monetary policies and tighten liquidity, the resultant spike in interest rates would further worsen the global economic outlook.

Also, given the developed economies are faced with inflation levels much lower than otherwise deemed necessary for maintaining healthy economic growth, validates the argument against a rise in global interest rates, specially the Fed rates.Therefore, if t he Fed rate hike is further delayed, it will be good news for developing economies such as ours since the government could tap the overseas markets for deficit financing rather than looking inward and push up the domestic market rates.Given this scenario and if the government still is focused on maintaining fiscal deficit targets, domestic interest rates are expected to be sticky in 2015 and would bode well for the equity markets.

However, it should be noted that still the consensus suggests t he Fed rates might rise by around 37 basis points, which is a near 30 percent increase from the current level by end-2015. In this backdrop, the Central Bank had mentioned its intent to tap Chinese debt investors and t hereby reduce t he dependence on Western markets for borrowings.Despite abundance of Chinese debt, it has thus far been for project financing and not by way of government debt securities and issuing government debt in foreign currency other than in US dollars could enable the policymakers to effectively benefit from the bilateral trade flows.

UNLIKELY GLOBAL ECONOMIC RECOVERY

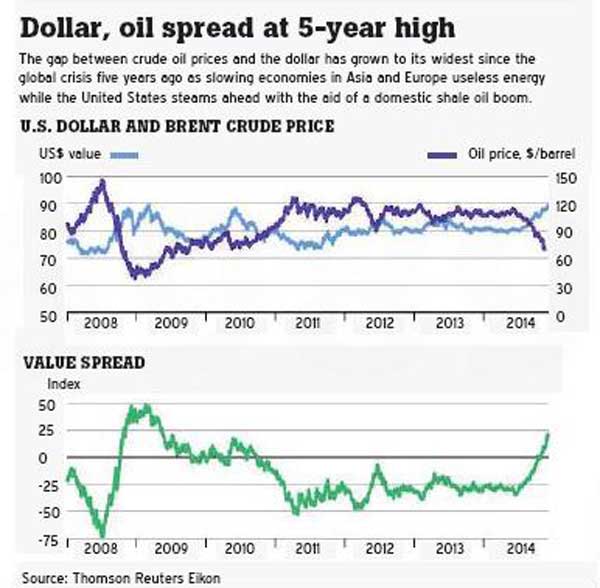

Growth rates in China and Europe are waning and creating more burden for the much-anticipated global economic recovery which now seems unlikely in 2015. Therefore, next year, many economic challenges would present itself to the global economy.Oil prices have nosedived delivering a severe blow on global economic confidence. Questions are being raised as to if the oil price contraction is far more than required to beef up spending and achieve the minimum inflation targets for the developed world.And it seems that much more than pure economics is in play for this oil price contraction since it caps the earning potential of large oil producers such as Russia and Iran while also making both shale gas extraction and renewable energy investments uneconomical.

Though at the outset the collapse in oil prices (which has reduced by around 45 percent within a few months) is a big positive for net oil importers such as Sri Lanka, which can enjoy a reduction in import costs, enjoy hefty margins in fuel retailing and compensate for state inefficiencies, etc., the magnitude of the price drop and regions affected could become a double-edged sword at least in the local economic context.

While enjoying the free ride presented by cost savings in oil imports, the resultant contraction in earnings potential has delivered a bone-shattering punch to economies such as Russia, CIS countries and Iran, who indecently happen to be the largest buyers of Ceylon tea.Then the European economies are in a limbo and our garment exports are already showing signs of this future slowdown. It will be a matter of time till the Chinese slowdown crosses the Pacific Ocean and reaches the American shores and when that happens, Sri Lanka also would feel the pinch since our export earnings would suffer.

Therefore, with the developed economies going through a struggle to boost demand while trying their level best to avoid a deflationary scenario (which could result due to the sharp contraction in oil prices) gives all the more reasons for us to assume that prices of Gold and other non-food commodities are going to be sticky and prolong the adverse impact on the banking sector loan book in developing economies.

UNSPARED FRONTIER MARKETS

Oil price crash has not spared the frontier markets. Countries like Nigeria would feel the pinch with fresh investments into the oil and gas sectors disappearing in contrast to the expectation six months back. Ukrainian crisis is far from over and the country’s economy seems to be moving towards bad to worse.

Also, subsequent to the oil price dip, both the MSCI Frontier Market Index and MSCI Emerging Market Index have lost ground while the ASPI’s weakness at the CSE was not oil driven but more so based on the local political sentiment. Therefore, given this disconnect, it should be just a matter of time for the Colombo bourse to become a benefactor from this fall out when global portfolio funds attempt to reallocate money to frontier and emerging economies which would benefit from lower oil prices.

However, these freebees have a few strings attached and the main risk is posed by large US and UK-based global investment funds, which could face redemptions due to overall global economic weakness and/or frontier market weakness. And the risk is that when these larger funds try to honour their redemptions, they will start by cutting their positions in the more risky frontier market space.

Given the size of positions held by a few of these large investment companies, when a sellout happens, it would be a significant challenge to brake the ASPI’s decline at the CSE…if such an event is to take place! Such risk could have been mitigated if our capital markets received much more portfolio investments from fund management companies domiciled in the East and Middle East while in my opinion we are still not too late to attract such investments.

Look Eastis a great strategy championed by the policymakers given the macroeconomic scenario and I also believe that in 2015 the CSE and market regulators would pursue the same strategy in an attempt to attract portfolio investments.Nevertheless, despite all these external developments finally the attractiveness of the CSE will depend on the corporate profit growth and the market valuations. There would be a limit to as how long the relative macro attractiveness of Sri Lanka could manage to keep the ASPI and the Colombo bourse upbeat.

Sooner rather than later corporate profit growth needs to display some marked improvement and the market valuations needs to become compelling to attract fresh investments. However, still there seems to bea disconnect between the macroeconomic growth and the rise in consumer consumption.Domestic consumption seems to be weak given the stickiness in corporate revenue growth and private sector credit growth. Crowding out of the private sector and stagnation in private sector job creation over the past few years would not bode well with the CSE’s growth aspirations, since sustainable capital market development would become a reality only if private sector development is kick started.

(Danushka Samarasinghe is the COO of Softlogic Stockbrokers and has been involved in Sri Lanka’s capital markets since 2002, before which he was attached to MAS Holdings. Also, he currently serves as the President of ACCA Sri Lanka. He can be contacted atdanushka80@gmail.com)

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul