Reply To:

Name - Reply Comment

Last Updated : 2024-04-20 00:00:00

By Chandeepa Wettasinghe

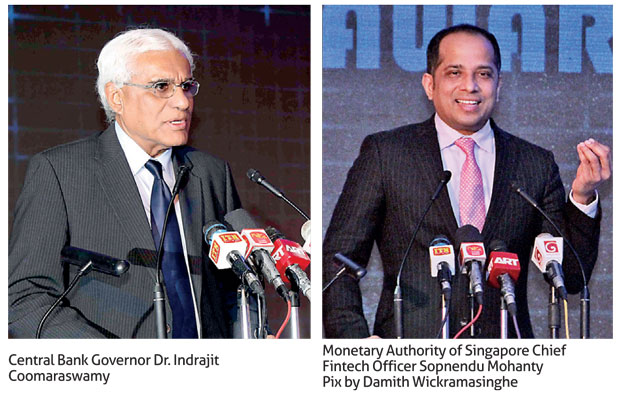

Sri Lanka’s Central Bank Governor Dr. Indrajit Coomaraswamy is advocating a more measured approach to financial technology (fintech) in the country, despite the significant industry opportunities highlighted by an official from the Singaporean Central Bank.

“What we have been thinking of in the Central Bank is how we respond to fintech. One worry is whether the disruptive aspects of fintech would cause damage to the market, the banking and non banking financial institutions,” he said.

He said that while the Central Bank cannot ignore the potential benefits of fintech, technological progress has to be moderated in order to prevent too much disruption in the financial services sector.

“You can have a modular approach to phase this in,” he said.

Dr. Coomaraswamy noted that resisting change will also not be to the benefit of the market, since the service providers might disappear like dinosaurs, once consumers start using fintech not provided by the traditional market players.

“We shall disappear if we can’t adapt in an environment, which contains spaceships, computers and thermonuclear weapons.

Today, 17 years later, this sentiment is more pertinent and bears greater resonance as we are going through the 4th industrial revolution, characterized with robotics, artificial intelligence and 3D printing,” he said.

Fintech such as virtual currencies, peer-to-peer transactions among consumers and businesses, and more innovations to come could gradually end even the relevance of central banking, according to financial sector analysts.

However, Dr. Coomaraswamy expressed confidence in the Sri Lankan central bankers to grasp fintech better by noting how the Central Bank had set up LankaPay’s parent LankaClear (Pvt) Ltd back

in 2002.

Fiscal policy interferences however have already threatened this position held by the Central Bank.

Former Finance Minister Ravi Karunanayake, during the 2017 budget, proposed to set up a separate national payment gateway under the ICT Agency outside the purview of the Central Bank to facilitate peer-to-peer transactions, which drew widespread criticism.

Ironically, Karunanayake in the same budget proposed to protect the traditional leisure sector from innovative tourism technologies.

Meanwhile, Monetary Authority of Singapore Chief Fintech Officer Sopnendu Mohanty, who briefly touched upon the drawbacks of fintech, however said that the narrative has changed over the past 2-3 years into the situation today where fintech could gain more by collaborating with traditional market players.

He said that Sri Lanka could become a world-class fintech centre based on the demographics of the country.

“I think Sri Lanka could be a world-class centre for fintech to succeed. I truly believe that and I’m surprised at the (level of) fintech in Sri Lanka today. When I go back to Singapore, I will insist my Central Bank Governor to partner with Sri Lanka to work on fintech,” Mohanty said.

He gave a number of policy suggestions for Sri Lanka to develop a fintech environment as complex as in Singapore, which Dr. Coomaraswamy said that Sri Lanka should learn from.

Mohanty heavily stressed that investments in cyber security would be required in order to rely on fintech.

Meanwhile, Governor Coomaraswamy quipped that foreigners have more confidence in Sri Lanka and its economic prospects than the local private sector.

“Foreigners seem to have faith in the future of Sri Lanka, which doesn’t seem to be shared by our local private sector,” he told an audience full of bankers at the recently held LankaPay Technovation Awards 2017 in Colombo.

The Governor was basing his opinion on the fact that the US$ 1.5 billion sovereign bond issued in May was oversubscribed by seven times, while the local firms were seen holdings back their investment, adopting a ‘wait and see’ approach.

The Colombo Stock Exchange has been experiencing positives interest from foreigners as well, with net foreign inflows of approximately US$ 125 million for the first 5 months of 2017, up from a net foreign outflow of US$ 37.3 million during the same period in 2016.

Dr. Coomaraswamy said that the situation is not the fault of the local private sector, since government policies have been inconsistent in the past.

“The government has been constraining itself. There was no predictable or consistent policy. That is what I was trying to explain to you. In terms of the framework we’re putting in place, so hopefully, going forward all of you in the private sector will think carefully about recalibrating your risk appetite,” Dr. Coomaraswamy added.

He said that the Central Bank will be trying its best to maintain stable price levels through inflation targeting, while the fiscal policies will aim to reduce the budget deficit and the ‘stop and go’ cycles that led to a heavy debt burden.

Despite Dr. Coomaraswamy’s comments on the confidence of foreigners, foreign direct investments (FDIs) to Sri Lanka over the past 5 months were termed as ‘nothing significant’ by Fitch Lanka Managing Director Maninda Wickramasinghe earlier this month.

The Central Bank in a puzzling move has stopped publishing FDI information in its monthly external sector statistics bulletin.

FDI inflows to Sri Lanka in 2016 amounted to less half a billion dollar, most of which arrived in the latter part of the year.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t