Reply To:

Name - Reply Comment

Last Updated : 2024-04-19 11:48:00

By Chandeepa Wettasinghe

Although private credit growth is expected to fall down to a manageable 20 percent by the end of this year and all macroeconomic targets are to be achieved, the Central Bank refused to rule out a rate hike over the next six months, while keeping rates unchanged during this month’s policy review.

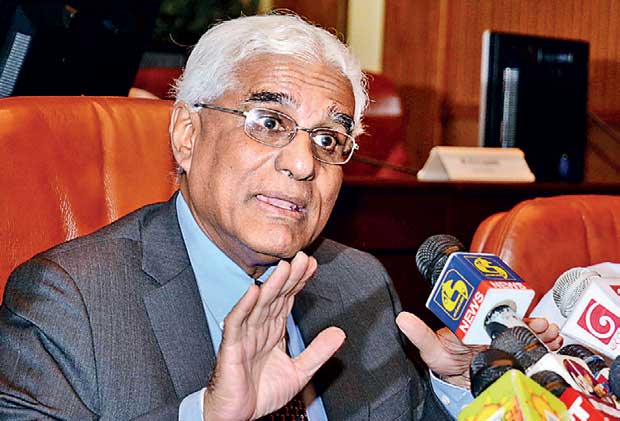

“We have not seen the August figures as yet. But we expect it (private credit) to start slowing down from the last quarter of this year. The expectation is that by the end of the year it will slow down to 20 percent,” Central Bank Governor Dr. Indrajit Coomaraswamy told a press briefing yesterday.

He said that the historic trend of the effects of policy tightening being experienced 12-18 months down the line is still valid and that after the recent tightening, consumption-led credit has tapered off, while most credit is now directed towards construction and real estate.

However, this is despite unusually high rates of land and construction prices.

The Central Bank brought in a 150-basis point increase to the Statutory Reserve Ratio last December, followed by two 50-basis point hikes of policy rates in February and July this year, when the private credit growth was at levels around 25 percent.

The monetary policy review for September left the policy rates unchanged, while broad money expansion in July increased 17.8 percent year-on-year (YoY) and 17 percent compared to June.

Private credit growth increased to 28.5 percent YoY in July, slightly up from 28.2 percent in June, while net credit to the government increased by Rs.272.5 billion YoY for the first seven months of this year, even though credit to public corporations decreased by Rs.50.9 billion YoY in the same period.

Earlier this year, the Central Bank had said that credit growth above 15 percent was dangerous, but towards the latter part of the year said that 20 percent was manageable.

Dr. Coomaraswamy noted that all monetary and fiscal policy targets are on course to be achieved this year, but noted that all policy instruments are available and may be used over the next two quarters.

“It’s very unwise to rule anything out. We keep monitoring all the time. We will look at all instruments, but right now we’re happy of the current policies leading us to our target,” he said.

However, he refused to comment to over what extent macroeconomic indicators such as inflation had to swell, before moving for a policy rate hike, and said that all meetings and announcements on changes of policy rates would be done after the close of the market, to avoid manipulations.

He said that the effects of the value-added tax (VAT) hike, which is expected to be legislated over the next few weeks, will have limited impacts on inflation due to it only coming into effect for two months of this year and also due to the better implementation practices such as charging taxes only for VAT-liable goods.

Dr. Coomaraswamy said that there won’t be any more foreign borrowings this year and that more market forces will be allowed to determine the price of the rupee.

“We haven’t defended the rupee with reserves for the past few months and there have been net inflows, but the spot rupee has been fixed. We need market rates to come in, but we won’t allow any major volatility,” he said.

However, he noted that it was “tough to say” whether the US $ 6.6 billion foreign reserve was sufficient, with a balance of payments deficit of US $ 2.5 billion.

Meanwhile, Dr. Coomaraswamy noted that the economy is expected to rebound in the second half of this year, after droughts followed by floods, along with a high base in 2015, dragged down the second quarter gross domestic product (GDP) growth to

2.2 percent.

“We see the growth picking up in the second half. There’s a pick up in the Purchasing Managers Index and a pick up in business confidence. There was also very low growth in the fourth quarter last year, so the low base will contribute to an increase,” he said.

While noting that a GDP growth below 5.5 percent for the next three to five years would be both unlikely and disappointing, he said that the challenge would be to accelerate growth to 7-8 percent, since the debt and construction-led economy overheated in the past when growth exceeded 6 percent.

He said that the government’s plans to cultivate relationships and bring in foreign direct investment from capital-rich countries like China and Japan, as well as the widening of trade ties with India, China and Singapore will make the difference in the future.

“I’m fairly bullish about the growth prospects if you take a three- to five-year view, but as the stabilization programme works through, in the next 12-18 months, I don’t see a big pick up. But I think we would maintain 5 percent plus, 5.5 percent,”

he said.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

A recent post on social media revealed that three purple-faced langurs near t