Reply To:

Name - Reply Comment

Last Updated : 2024-04-24 11:56:00

axation is a key public policy instrument that modern democratic States use to reduce social inequality and ensure equality of opportunity in diverse spheres such as food consumption, education, health and social protection.

axation is a key public policy instrument that modern democratic States use to reduce social inequality and ensure equality of opportunity in diverse spheres such as food consumption, education, health and social protection.

Though conventional Marxist analysis expected a steady increase in economic and social inequality under capitalism, social and political reforms in many capitalist societies in Europe and elsewhere under social democratic regimes resulted in a steady decline in inequality.

However, in many parts of the world, income inequality has been on the rise in recent decades. This has been partly due to the declining role of the state in economic management and the redistribution of wealth in society and partly due to a deliberate attempt to keep the personal and corporate taxes low, largely due to the increasing influence of vested interests.

Lower taxes naturally reduce the share of national wealth controlled by the state resulting in lower public spending and higher levels of private consumption in such areas as education, health,  transport, leisure and housing.

transport, leisure and housing.

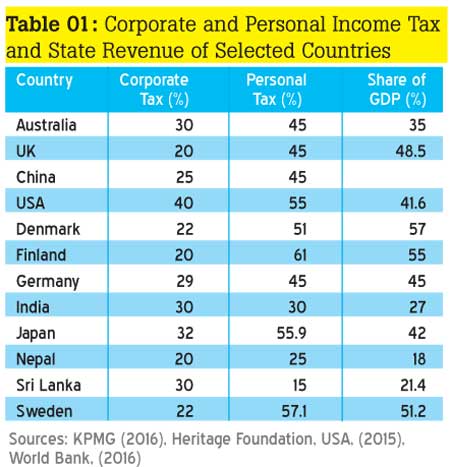

The data in the following table indicates how diverse the countries are even today in terms of rates of taxation, State tax revenue as a proportion of the GDP and public spending as a share of the GDP. As is evident from the data, the extent of public spending in a country is dependent on the tax revenue of the State. On the other hand, income inequality is also a product of the rate of taxation. This is not difficult to understand, because higher taxes naturally reduce the nett income of higher income groups. In countries where higher rates of personal income tax are levied, the gap between the highest and the lowest income groups is consistently low.

As the data clearly shows, the government’s share of the GDP is over 50% in countries like Denmark, Sweden and Finland. In these countries, the highest rate of personal income tax is over 50%.

On the other hand, the government’s share of the GDP is countries like Sri Lanka and Nepal is very low. This is partly due to very low rates of taxation in these countries. Other reasons for this situation include the ratio of regular, formal employment to informal, irregular employment and the presence or the absence of minimum wage legislation. Whatever the reasons, the ability of the State in some countries to control a large share of the GDP enables it to divert adequate resources into critically important social sectors like health, social protection and public transport. (Table 1)Another important function of higher taxes on corporate and personal income is to reduce income inequality between the rich and the poor. This is clearly evident from the data on Table 2.

While income inequality in all countries listed in the following Table is very high before tax, income inequality has come down drastically after tax. This is further evident from the data in column 3 on  the ratio of income of the highest and the lowest income groups. As is evident, Japan has the lowest income gap of 4.5, compared with nearly 16 for the USA.

the ratio of income of the highest and the lowest income groups. As is evident, Japan has the lowest income gap of 4.5, compared with nearly 16 for the USA.

In other words, Japan has the most equal income distribution, even better than some of the European Welfare States like Denmark, Finland, Norway and Sweden.

For comparison, Sri Lanka’s ratio is over 11, which is worse than those of developed welfare States. It should also be noted that Sri Lanka’s income inequality has become worse over the last several decades. This is evident from the Household Income and Expenditure Surveys conducted by the Department of Census and Statistics of Sri Lanka. Table 2:

Higher levels of income inequality are not only unjust and dehumanising for the poor but also have other significant economic and social implications.

Firstly, higher personal incomes of wealthier people, at least partly due to lower taxes, lead to increasingly wasteful and conspicuous private consumption.

In a country like Sri Lanka, such consumption involves importation of luxuries such as expensive motor cars and household gadgets and overseas spending such as foreign education, private healthcare and holidays.

All these inevitability contribute to the widening trade gap in the country.

As one might expect, higher taxes on incomes under democratic regimes committed to rational policy making would divert at least part of the additional State revenue collected for social investments that benefit lower income groups and vulnerable sections of the population.

Besides, increased social investments in such areas as health and education are more than likely to improve the life chances of the underprivileged groups, creating a more equitable, just and contended society.

It is well known that most people in Sri Lanka earn low and irregular incomes and therefore do not pay direct taxes.

In other words, only a small proportion of the people are liable to pay direct taxes.

So, when the rate of taxation is also as low as 15%, actual direct taxes levied amount to a small proportion of the GDP. This has several implications. Firstly, the government resorts to indirect taxes to shore up state revenue, forcing everybody to pay taxes irrespective of their level of income.

Secondly, a very low rate of taxation imposed on higher income groups leaves most of their income intact, enabling them to use it for private consumption.

Thirdly, lower level of taxation deprives the government of much needed capital for public investment. And finally, growing income inequalities translate into acute social disparities leading to a growing  sense of social injustice and marginalization among underprivileged groups. We have witnessed in the recent past in this country the adverse impacts of such trends on social peace and political stability.

sense of social injustice and marginalization among underprivileged groups. We have witnessed in the recent past in this country the adverse impacts of such trends on social peace and political stability.

Social disparities arising out of worsening income inequalities in Sri Lanka are clearly evident in many sectors today. These are transport, health, education, housing and social protection.

Many elderly people cannot retire and rest and therefore, they continue to work because the government cannot provide them with adequate income support. Many poor people have become squatters on public land such as railway and road reservations because they cannot afford to pay for land and decent housing.

Our congested roads in urban areas display in no uncertain terms the failure of the State to contain growing income inequalities through progressive taxation and other public policies.

It is distressing to witness the unceasing and at times ugly struggles for dwindling road space involving the whole spectrum of society.

Many poor people who are suffering from life threatening, chronic ailments often go from house to house or wait at congested road intersections begging for money to pay for life saving drugs, medical tests and food, while the members of the elite take the earliest available flight to a developed country for medical treatment.

There cannot be any disagreement that economic development is a necessary precondition for resolving key social and economic issues in the country but there is no justification for maintaining wide income inequalities through unsound public policies.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul